Life insurance is a key component of any comprehensive insurance or financial plan. A proper Life Insurance plan is required so your family can maintain the same or similar standard of life even after you have passed away. It protects your family’s financial future that you have worked so hard to provide.

Life Insurance is made up of 2 key components – Insured and Beneficiary. Insured is you and Beneficiary is your spouse and/or kids or any other person or entity you want. Most life insurance policies are purchased to provide financial security in case a spouse passes away. In today’s Canada almost 70% of the households are dual income. This means majority of Canadians have jobs or businesses to provide for a certain standard of living to their loved ones. If this sounds familiar or personal circumstance, then you need life insurance. There are no second thoughts. To elaborate a little more we have provided some reasons which are applicable to all of us.

There are many reasons one needs Life Insurance. We have outlined just 5 which are applicable to most of us:

Life Insurance is made up of 2 key components – Insured and Beneficiary. Insured is you and Beneficiary is your spouse and/or kids or any other person or entity you want. Most life insurance policies are purchased to provide financial security in case a spouse passes away. In today’s Canada almost 70% of the households are dual income. This means majority of Canadians have jobs or businesses to provide for a certain standard of living to their loved ones. If this sounds familiar or personal circumstance, then you need life insurance. There are no second thoughts. To elaborate a little more we have provided some reasons which are applicable to all of us.

There are many reasons one needs Life Insurance. We have outlined just 5 which are applicable to most of us:

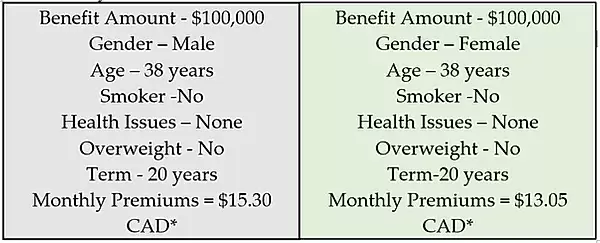

- Pay for your own funeral expenses - Today the cost of a decent funeral ranges from $8000 to $30,000. If you died today your family must come up with this expense right away. This is paid through their savings or line of credit or personal loan if you do not have a life insurance in place. Life Insurance policies start from pennies a day for very basic coverage of $100,000. Please see two illustrations below for your reference.

Reduce Stress On Your Loved Ones With Life Insurance

*Please note the above example is through one of the many Life insurance companies we represent. The premium was calculated on December 31, 2018. We do not price match with other insurance companies. Your insurance premium depends on your age, smoking status, health, gender, health, family medical history, past medical history etc. Please consult one of our licensed life insurance advisors to discuss your life insurance needs.

- Pay off the creditors – If you have any personal loans, credit card debt, outstanding bills, car loans, business loans etc. then you should be aware that most of this debt is passed on to your estate, not the family members. Once the debt is paid off the beneficiary gets what is left of the estate. You can plan so such debts are paid by your Life Insurance and the beneficiaries of your estate get what you want them to have. It’s a great tool for estate planning.The proceeds or benefit amount in a life insurance policy is creditor protected – it means the creditors cannot stake a claim in the life insurance policy benefit amount.

- Quick and effective way to protect the family's living standards. – If one spouse passes away untimely or not it leaves a huge financial void in the family’s finances. It does affect the family. You can plan for this event well in advance by sitting with our licensed Life Insurance Advisor in Durham, Ontario. We at Aaxel Insurance Brokers Ltd, Durham Branch will guide you and help you create a life insurance plan. Life Insurance policy is an easy solution to a complex problem. You can choose who should get the proceeds of the policy. The medicals are done before the policy is issued so the benefit amount is guaranteed. As we say – Life Insurance Policy never replaces you, but it guarantees your family’s standard of living does not go down if you were not present to oversee it.

- Pay off your potential estate taxes – As mentioned earlier Life Insurance is a great way to pay off Estate Taxes. It guarantees that your beneficiaries get what you want them to have. Depending on the size of the estate you need life insurance. You should always speak to an Qualified Life Insurance advisor in our team to determine the amount of Insurance you need.

- Gift for a favourite charity or person – You can also name a charity or your favourite nephew, niece, grand child etc as the beneficiary. Some people pay off their great grand child’s tuition with a life insurance policy. There are many ways you can impact someone’s life using a life insurance policy. You need to get this right so there are no problems amongst your surviving family members. Call us and set an appointment with one of our Licensed Life Insurance Advisor, we will assist you through the process of naming a beneficiary

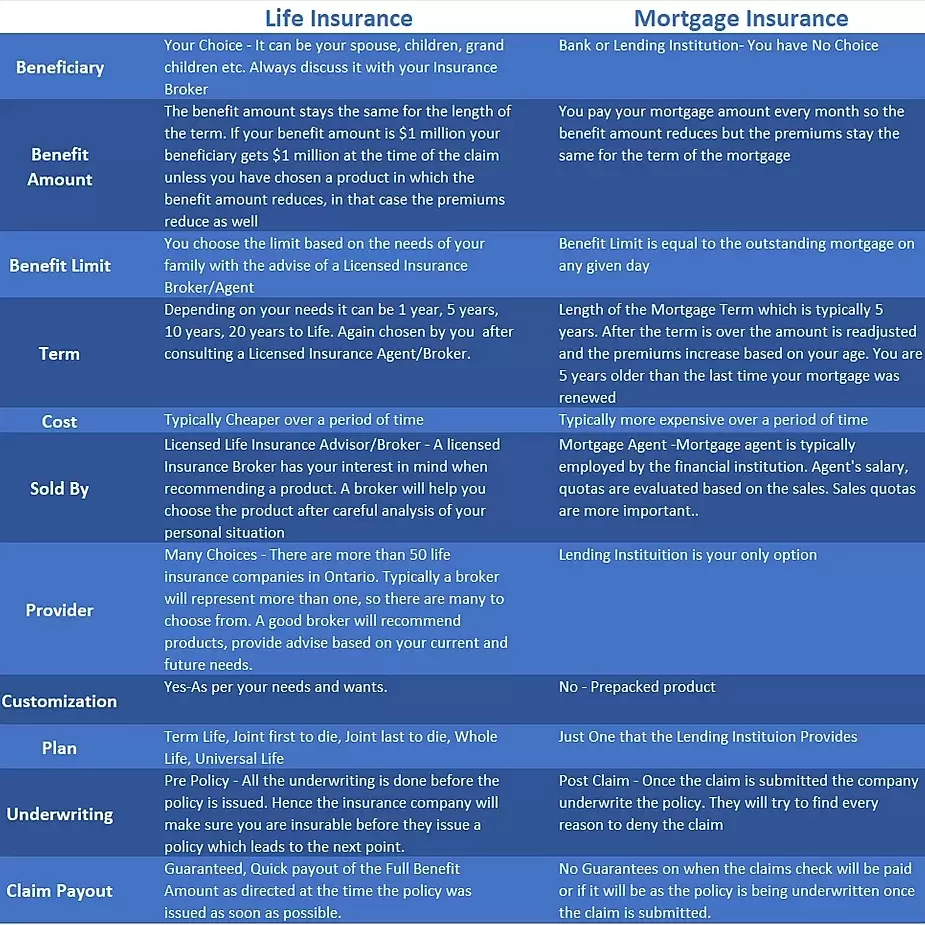

- If you have a mortgage, you need Life Insurance.- This is not rocket science. How many times you have heard that mortgage insurance does not pay even in case of death and the surviving spouse is not able to afford the mortgage on single salary. This results in either the house being taken over by the lending company or a legal battle. Let us see the key differences between a mortgage insurance and life insurance policy:

Please watch this video on youtube.com for more information on why NOT to buy mortgage insurance

There are 3 types of life insurance policies – Term Life Insurance, Universal Life Insurance and Whole Life Insurance. They are all important because they all be efficiently used to meet the needs.

Term Life Insurance

This is often called temporary life insurance policy as it ends or renews at the end of the term. It can be 1-year term, 2-year term up to 40-year term. The need for such a product is based on your life stage. We can help you determine whether a term life insurance is a product you need or not. A term life insurance is a quick and easy solution if you have a mortgage as well. You can add some riders like critical illness to certain term insurance policies. For a term Life insurance in Durham region please call to book an appointment or send us a quick message using the link below.

Permanent Life Insurance

There are 2 categories of Life Insurance when we talk about permanent life insurance – Whole Life insurance and Universal Life Insurance. These policies are best solution for long term goals. They both offer payment plans where the policy can be paid off in certain time frame – usually in the earning years. There are some differences between these 2 policies, and we will be happy to explain them to you. There is also a cost difference between universal life insurance and whole life insurance. Please call us at 289 274 4807 and one of Aaxel representatives will discuss your details. We provide no obligation quotes upon your request. Please call to book an appointment or send us a quick message using the link below. We will provide a solution so you can sleep peacefully at night knowing in the event you don’t wake up your family is financially protected.

Medical Life Insurance vs Non-Medical Life Insurance – What is best for me?

This question comes to your mind quiet often when you think about life insurance. With so much in media, advertisements etc. it is difficult to decide. We understand. We will walk you through this decision making. The basic difference is that in Medical Life Insurance or regular Life Insurance the insurance company will do the medicals before issuing the policy. Sometimes they may not need medicals if the amount of insurance is too low, yet it is the regular life insurance. On the other hand, Non-Medical Life Insurance is a product in which the insurance company will not do a single medical test before issuing the policy. It is usually quick and cost-effective solution for someone with a pre-existing medical condition. We will shop the market for you to get you the best deal for your life insurance. Please call to book an appointment or send us a quick message using the link below.

We at Aaxel Insurance Brokers Ltd, Durham Branch will provide a comprehensive plan to protect your loved ones in the event of your untimely death. Aaxel Insurance Brokers Ltd., Durham Branch serves the Life Insurance Needs of residents of Oshawa, Pickering, Whitby, Ajax, Uxbridge, Scugog, Bowmanville, Port Perry, Courtice, Beaverton, Sunderland, Clarington, Newcastle, Brock, Claremont, Altona, Goodwood, Uxbridge, Cannington, Orono, Mt Albert and the rest of Ontario.

If you are looking for a broker who diligently works for you, provides excellent client experience and very competitive premiums from Financially Stable Insurance companies, call us at 289 274 4807. For an appointment to discuss your insurance needs, please contact us. We will set up an appointment at your convenience and will personally come to your workplace or home or local coffee shop (coffee will be on Us) to discuss all your insurance needs.

Critical Illness Insurance

The inventor of Critical Illness insurance product was a Cardiac Surgeon in South Africa Named Dr Marius Barnard. He was also a member of a team that performed the first successful human to human heart transplant in 1967. The idea behind the development of the insurance policy was that a serious illness reduces your capacity to earn or afford medical treatment.

Critical Illness would pay lumpsum in the event you are diagnosed with an illness on the list provided by the insurance company. This is an amazing product to protect your cash flow while you recover from your illness. Hence Critical Illness is called Living benefits product. It pays while you are alive unlike life insurance. This is one product in every good financial plan.

Critical Illness can be a separate policy or added as a rider on a life insurance policy. You need to discuss with your advisor on what is the best for you. Critical illness insurance covers an individual against certain illnesses. This policy is typically sold in – 10-year, 20-year, up to age 65, up to age 75 etc. terms through various insurance companies. You can get basic plan with 4 illnesses to comprehensive plan of 25 illnesses.

The basic plan is cheaper and more affordable for the same person as compared to the more comprehensive plan. Talk to your Local Licensed Durham Insurance Broker at Aaxel Insurance Brokers Ltd to discuss what is suitable for you.

The basic 4 illness plan covers – Life Threatening Cancer, Heart Attack, Coronary Artery Bypass Surgery and Stroke. The full comprehensive plan usually covers - Motor Neuron Disease, Heart Attack, Stroke, Heart Valve Replacement or Repair, Aortic Surgery, Aplastic Anemia, Bacterial Meningitis , Benign Brain Tumor , Blindness, Life Threatening Cancer, Coma, Coronary Artery Bypass Surgery, Deafness, Dementia (including Alzheimer’s Disease), Kidney Failure, Loss of Speech, Major Organ Failure on Waiting List, Major Organ Transplant, Loss of Independent Existence, Loss of Limbs, Severe Burns Multiple Sclerosis, Occupational HIV Infection, Paralysis and Parkinson’s Disease (Specified Atypical Parkinsonian Disorders).

Why is Critical Illness so Important?

Critical Illness is a policy that pays a lump sum amount to YOU if you are diagnosed with one and survive a certain number of days. The days you need to survive is called the waiting period and is usually about 30 days unless specified otherwise. The lesser the waiting period, the better it is for you and your family. This policy pays you while you are alive. You can use the money to pay for what ever you want – mortgage, car loan, credit card debt, medical bills, out of country check up, world tour with family etc.

In Ontario OHIP pays for most of the medical bills but it does not pay for your mortgage, living expenses, certain medical bills etc. This is the void Critical Illness policy aims to fill. Critical Illness helps you maintain your family’s standard of living and avoids digging into your valuable savings or emergency fund. This allows you a stress-free time to recover from your illness and does not cause any financial problems.

Secondly due to advanced medical science people tend to survive a diagnosis as compared to 30 years ago. This results in less deaths due to many medical conditions today as compared to 30 years ago. What this means is yes you will be saved from a heart attack and live many years, but you may not have the money to support your family, right after the illness as your employee benefits will run out or you just don’t have your job or business. You have worked hard all your life to build something. Is it worth loosing it due to sickness/illness related income loss? Give us a call at 289 274 4807 and we will provide a free, no obligation quote for your critical illness insurance.

Finally, most Critical Illness Policy providers have some additional inbuilt features like second opinion service. You need to speak to your Local Licensed Durham Insurance Broker at Aaxel Insurance Brokers Ltd to discuss the terms and conditions in more details.

Critical Illness is a very important Living Benefit you should have in your financial plan. This benefit pays while you are alive. Sometimes Critical Illness is included in the employee medical benefits plan provided by your employer. Make yourself familiar with it and check to see if it is the basic one or the more comprehensive one.

Disability Income Protection Insurance or Disability Insurance

Disability Insurance or disability income protection is also an important Living benefit in any insurance plan. As the name suggests it provides an benefit amount in the event you are disabled. There are many disability insurance or disability income protection providers in Ontario but it is important to know what your are covered for before you buy the insurance. We do all the research for you and find the right product for you.

Disability Insurance is very important for a self employed, small business owner, contractor or any one who is their own source of income. If you are disabled due to an unforeseen event or illness and you lose main source of income, Disability Insurance will replace that income and pay for expenses that your family will incur due to your situation. The benefit amount is tax free in most cases. This is the reason it is such an important insurance coverage for contractors, self employed, professionals, tradespersons.

Many employers provide Disability Insurance as a part of their employee benefits program. They will provide both short term disability and long-term disability coverage. If you have Disability Income Protection or Disability Insurance as a part of the Employee Insurance Benefits program you should consult the Insurance Provider for details as it varies from company to company.

Disability can be injury related or sickness related. But in either case the Disability Insurance pays a monthly benefit amount. This amount is chosen by yourself but based on your financials it needs to be approved by your insurance provider.

The premiums that you pay are based on a few parameters – your income, occupation, gender, elimination or waiting period, any additional complementary coverages you have added to the policy etc.

Disability Insurance is a very complicated Insurance product you can ever purchase. We at Aaxel Insurance Brokers in Durham Region understand this very issue and hence are here to help you choose the right program with right company. We are your Living benefits Specialist in Oshawa, and we will ensure you are insured properly with very financially strong Disability Insurance Company.

Please note there are government programs and benefits for residents of Ontario and Canada. Some links are provided below for more information:

At Aaxel Insurance Brokers, Durham Location, we provide Life Insurance, Non Medical Life Insurance, Critical Illness Insurance, Disability Income Protection Insurance, Group Benefits, Long Term Care etc.

Please call our office at 289 274 4807 to book an appointment with one of Our Licensed Life Insurance Advisers to discuss your Life Insurance needs. We will spend the time to discuss your needs and provide a no obligation comprehensive Insurance plan for you after completing a thorough analysis.

We are your local living benefits specialists in Oshawa, Whitby, Pickering, Ajax and the rest of Durham Region.

There are 3 types of life insurance policies – Term Life Insurance, Universal Life Insurance and Whole Life Insurance. They are all important because they all be efficiently used to meet the needs.

Term Life Insurance

This is often called temporary life insurance policy as it ends or renews at the end of the term. It can be 1-year term, 2-year term up to 40-year term. The need for such a product is based on your life stage. We can help you determine whether a term life insurance is a product you need or not. A term life insurance is a quick and easy solution if you have a mortgage as well. You can add some riders like critical illness to certain term insurance policies. For a term Life insurance in Durham region please call to book an appointment or send us a quick message using the link below.

Permanent Life Insurance

There are 2 categories of Life Insurance when we talk about permanent life insurance – Whole Life insurance and Universal Life Insurance. These policies are best solution for long term goals. They both offer payment plans where the policy can be paid off in certain time frame – usually in the earning years. There are some differences between these 2 policies, and we will be happy to explain them to you. There is also a cost difference between universal life insurance and whole life insurance. Please call us at 289 274 4807 and one of Aaxel representatives will discuss your details. We provide no obligation quotes upon your request. Please call to book an appointment or send us a quick message using the link below. We will provide a solution so you can sleep peacefully at night knowing in the event you don’t wake up your family is financially protected.

Medical Life Insurance vs Non-Medical Life Insurance – What is best for me?

This question comes to your mind quiet often when you think about life insurance. With so much in media, advertisements etc. it is difficult to decide. We understand. We will walk you through this decision making. The basic difference is that in Medical Life Insurance or regular Life Insurance the insurance company will do the medicals before issuing the policy. Sometimes they may not need medicals if the amount of insurance is too low, yet it is the regular life insurance. On the other hand, Non-Medical Life Insurance is a product in which the insurance company will not do a single medical test before issuing the policy. It is usually quick and cost-effective solution for someone with a pre-existing medical condition. We will shop the market for you to get you the best deal for your life insurance. Please call to book an appointment or send us a quick message using the link below.

We at Aaxel Insurance Brokers Ltd, Durham Branch will provide a comprehensive plan to protect your loved ones in the event of your untimely death. Aaxel Insurance Brokers Ltd., Durham Branch serves the Life Insurance Needs of residents of Oshawa, Pickering, Whitby, Ajax, Uxbridge, Scugog, Bowmanville, Port Perry, Courtice, Beaverton, Sunderland, Clarington, Newcastle, Brock, Claremont, Altona, Goodwood, Uxbridge, Cannington, Orono, Mt Albert and the rest of Ontario.

If you are looking for a broker who diligently works for you, provides excellent client experience and very competitive premiums from Financially Stable Insurance companies, call us at 289 274 4807. For an appointment to discuss your insurance needs, please contact us. We will set up an appointment at your convenience and will personally come to your workplace or home or local coffee shop (coffee will be on Us) to discuss all your insurance needs.

Critical Illness Insurance

The inventor of Critical Illness insurance product was a Cardiac Surgeon in South Africa Named Dr Marius Barnard. He was also a member of a team that performed the first successful human to human heart transplant in 1967. The idea behind the development of the insurance policy was that a serious illness reduces your capacity to earn or afford medical treatment.

Critical Illness would pay lumpsum in the event you are diagnosed with an illness on the list provided by the insurance company. This is an amazing product to protect your cash flow while you recover from your illness. Hence Critical Illness is called Living benefits product. It pays while you are alive unlike life insurance. This is one product in every good financial plan.

Critical Illness can be a separate policy or added as a rider on a life insurance policy. You need to discuss with your advisor on what is the best for you. Critical illness insurance covers an individual against certain illnesses. This policy is typically sold in – 10-year, 20-year, up to age 65, up to age 75 etc. terms through various insurance companies. You can get basic plan with 4 illnesses to comprehensive plan of 25 illnesses.

The basic plan is cheaper and more affordable for the same person as compared to the more comprehensive plan. Talk to your Local Licensed Durham Insurance Broker at Aaxel Insurance Brokers Ltd to discuss what is suitable for you.

The basic 4 illness plan covers – Life Threatening Cancer, Heart Attack, Coronary Artery Bypass Surgery and Stroke. The full comprehensive plan usually covers - Motor Neuron Disease, Heart Attack, Stroke, Heart Valve Replacement or Repair, Aortic Surgery, Aplastic Anemia, Bacterial Meningitis , Benign Brain Tumor , Blindness, Life Threatening Cancer, Coma, Coronary Artery Bypass Surgery, Deafness, Dementia (including Alzheimer’s Disease), Kidney Failure, Loss of Speech, Major Organ Failure on Waiting List, Major Organ Transplant, Loss of Independent Existence, Loss of Limbs, Severe Burns Multiple Sclerosis, Occupational HIV Infection, Paralysis and Parkinson’s Disease (Specified Atypical Parkinsonian Disorders).

Why is Critical Illness so Important?

Critical Illness is a policy that pays a lump sum amount to YOU if you are diagnosed with one and survive a certain number of days. The days you need to survive is called the waiting period and is usually about 30 days unless specified otherwise. The lesser the waiting period, the better it is for you and your family. This policy pays you while you are alive. You can use the money to pay for what ever you want – mortgage, car loan, credit card debt, medical bills, out of country check up, world tour with family etc.

In Ontario OHIP pays for most of the medical bills but it does not pay for your mortgage, living expenses, certain medical bills etc. This is the void Critical Illness policy aims to fill. Critical Illness helps you maintain your family’s standard of living and avoids digging into your valuable savings or emergency fund. This allows you a stress-free time to recover from your illness and does not cause any financial problems.

Secondly due to advanced medical science people tend to survive a diagnosis as compared to 30 years ago. This results in less deaths due to many medical conditions today as compared to 30 years ago. What this means is yes you will be saved from a heart attack and live many years, but you may not have the money to support your family, right after the illness as your employee benefits will run out or you just don’t have your job or business. You have worked hard all your life to build something. Is it worth loosing it due to sickness/illness related income loss? Give us a call at 289 274 4807 and we will provide a free, no obligation quote for your critical illness insurance.

Finally, most Critical Illness Policy providers have some additional inbuilt features like second opinion service. You need to speak to your Local Licensed Durham Insurance Broker at Aaxel Insurance Brokers Ltd to discuss the terms and conditions in more details.

Critical Illness is a very important Living Benefit you should have in your financial plan. This benefit pays while you are alive. Sometimes Critical Illness is included in the employee medical benefits plan provided by your employer. Make yourself familiar with it and check to see if it is the basic one or the more comprehensive one.

Disability Income Protection Insurance or Disability Insurance

Disability Insurance or disability income protection is also an important Living benefit in any insurance plan. As the name suggests it provides an benefit amount in the event you are disabled. There are many disability insurance or disability income protection providers in Ontario but it is important to know what your are covered for before you buy the insurance. We do all the research for you and find the right product for you.

Disability Insurance is very important for a self employed, small business owner, contractor or any one who is their own source of income. If you are disabled due to an unforeseen event or illness and you lose main source of income, Disability Insurance will replace that income and pay for expenses that your family will incur due to your situation. The benefit amount is tax free in most cases. This is the reason it is such an important insurance coverage for contractors, self employed, professionals, tradespersons.

Many employers provide Disability Insurance as a part of their employee benefits program. They will provide both short term disability and long-term disability coverage. If you have Disability Income Protection or Disability Insurance as a part of the Employee Insurance Benefits program you should consult the Insurance Provider for details as it varies from company to company.

Disability can be injury related or sickness related. But in either case the Disability Insurance pays a monthly benefit amount. This amount is chosen by yourself but based on your financials it needs to be approved by your insurance provider.

The premiums that you pay are based on a few parameters – your income, occupation, gender, elimination or waiting period, any additional complementary coverages you have added to the policy etc.

Disability Insurance is a very complicated Insurance product you can ever purchase. We at Aaxel Insurance Brokers in Durham Region understand this very issue and hence are here to help you choose the right program with right company. We are your Living benefits Specialist in Oshawa, and we will ensure you are insured properly with very financially strong Disability Insurance Company.

Please note there are government programs and benefits for residents of Ontario and Canada. Some links are provided below for more information:

- Ontario Disability Support Program commonly know as ODSP

- Federal Programs – Disability benefits Canada.

At Aaxel Insurance Brokers, Durham Location, we provide Life Insurance, Non Medical Life Insurance, Critical Illness Insurance, Disability Income Protection Insurance, Group Benefits, Long Term Care etc.

Please call our office at 289 274 4807 to book an appointment with one of Our Licensed Life Insurance Advisers to discuss your Life Insurance needs. We will spend the time to discuss your needs and provide a no obligation comprehensive Insurance plan for you after completing a thorough analysis.

We are your local living benefits specialists in Oshawa, Whitby, Pickering, Ajax and the rest of Durham Region.